Will the MDR tide lift all UPI apps? That’s the big question as we enter the critical phase of discussions and consultations around monetisation of UPI payments in India.

The absence of the merchant discount rate or MDR on UPI transactions has long been a pain point for startups. India’s fintech sector has invested billions in creating the infrastructure needed for UPI payments penetration but has not seen much in the way of revenue upside.

The industry has argued that the inability to monetise UPI offerings has resulted in loss-making apps which are struggling to keep up with the maintenance and expansion costs associated with being a high-volume payments app. However, there are signs that the end of the free UPI era is near.

In March, the Payments Council of India (PCI) wrote to Prime Minister Narendra Modi, asking to allow charging MDR on large merchants for transactions above INR 2,000. The demand was also supported by tech policy lobbying body Startup Policy Forum (SPF) as well as a host of fintech startups.

Some — such as MobiKwik and Paytm — have staked their future growth on the basis of MDR coming into the picture. But early discussions around this monetisation indicates that any MDR introduced would only be for UPI transactions above INR 2,000 processed by ‘large merchants’.

As per the RBI, a large merchant is defined as a business with an annual turnover greater than INR 20 Lakh in the previous fiscal year. Such merchants can earn up to 0.3% on each eligible transaction, as per the speculation around MDR rules currently.

It must be noted that MDR is not yet officially applicable, but as we have reported earlier, the industry is hopeful of positive news on this front.

MobiKwik CEO Bipin Preet Singh said recently that MDR talks are already in motion from the RBI “From our perspective, this will definitely introduce a new revenue stream that we are currently not receiving, making it essentially 100% profit for us from any Pocket UPI transactions.”

Such statements of optimism have come from others too, but the fact is that outside of the top three UPI apps, India currently has a long tail of UPI apps that don’t necessarily process such a high volume of transactions and where the average transaction size would not bring in much MDR upside.

Who among the UPI underdogs like CRED, Amazon Pay, Groww, MobiKwik, FamApp, Navi, Super.Money and others will be able to make the most of MDR? Or will this primarily boost the frontrunners?

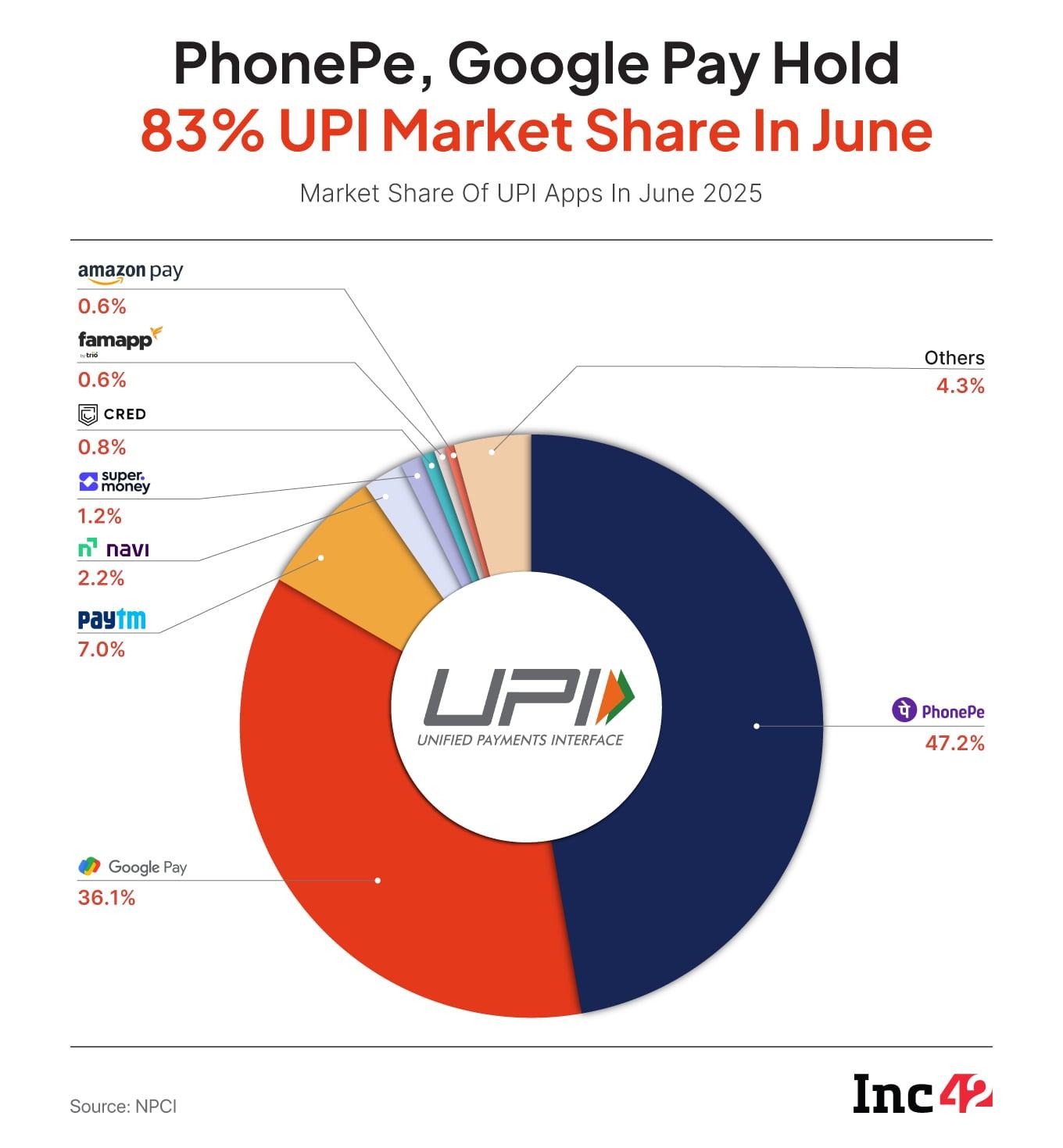

What NPCI’s UPI Data ShowsAccording to NPCI’s data for UPI transactions between January and June 2025, PhonePe, Google Pay and Paytm have consistently been the top three players, but the chasing pack keeps changing.

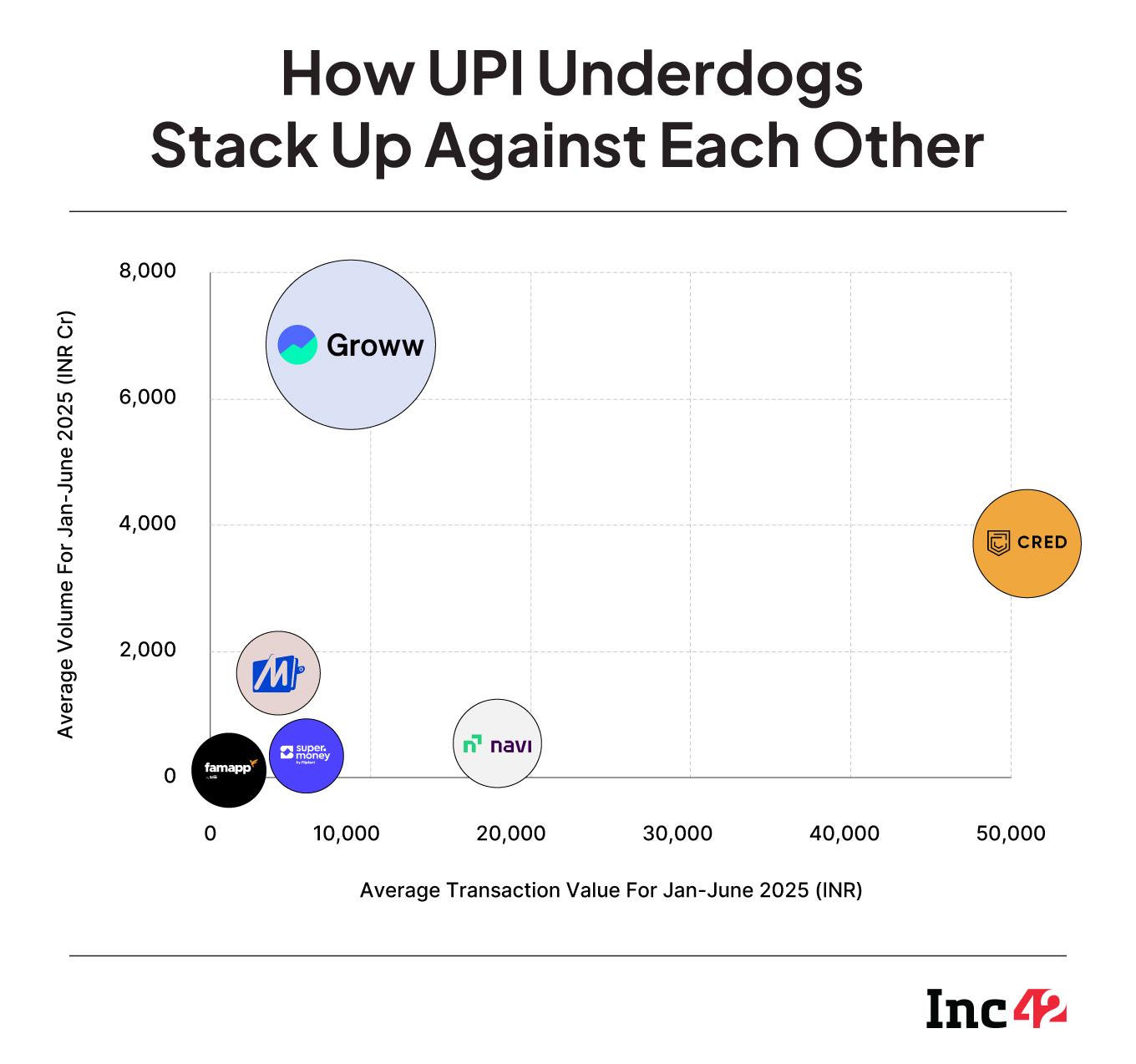

There are some standouts such as Groww and CRED when it comes to the average ticket size, but in terms of sheer volume of transactions, the top three dominate.

What’s of note is the average transaction size of the top three UPI apps – PhonePe, Google Pay, and Paytm – which is under INR 150. A far way off any potential MDR benefit.

This dichotomy of high market share and low average ticket size is what makes MDR a bit of a moot point at the moment. Apart from Groww and CRED, no other platform even comes close to the INR 2,000 mark per transaction.

This gives the two Bengaluru-based fintech giants a huge advantage if MDR becomes applicable. However, this would be with the disclaimer that these transactions are for large merchants as per the RBI’s definition.

The competition outside of the top three is intensifying, with over 50 UPI-enabled apps on the Google Play and Apple App Store, including newer entrants like Navi, CRED, super.money, FamApp, and Groww.

Besides this, a number of banks make up the list of UPI apps outside of the top three, though none of the banks have been used for our analysis.

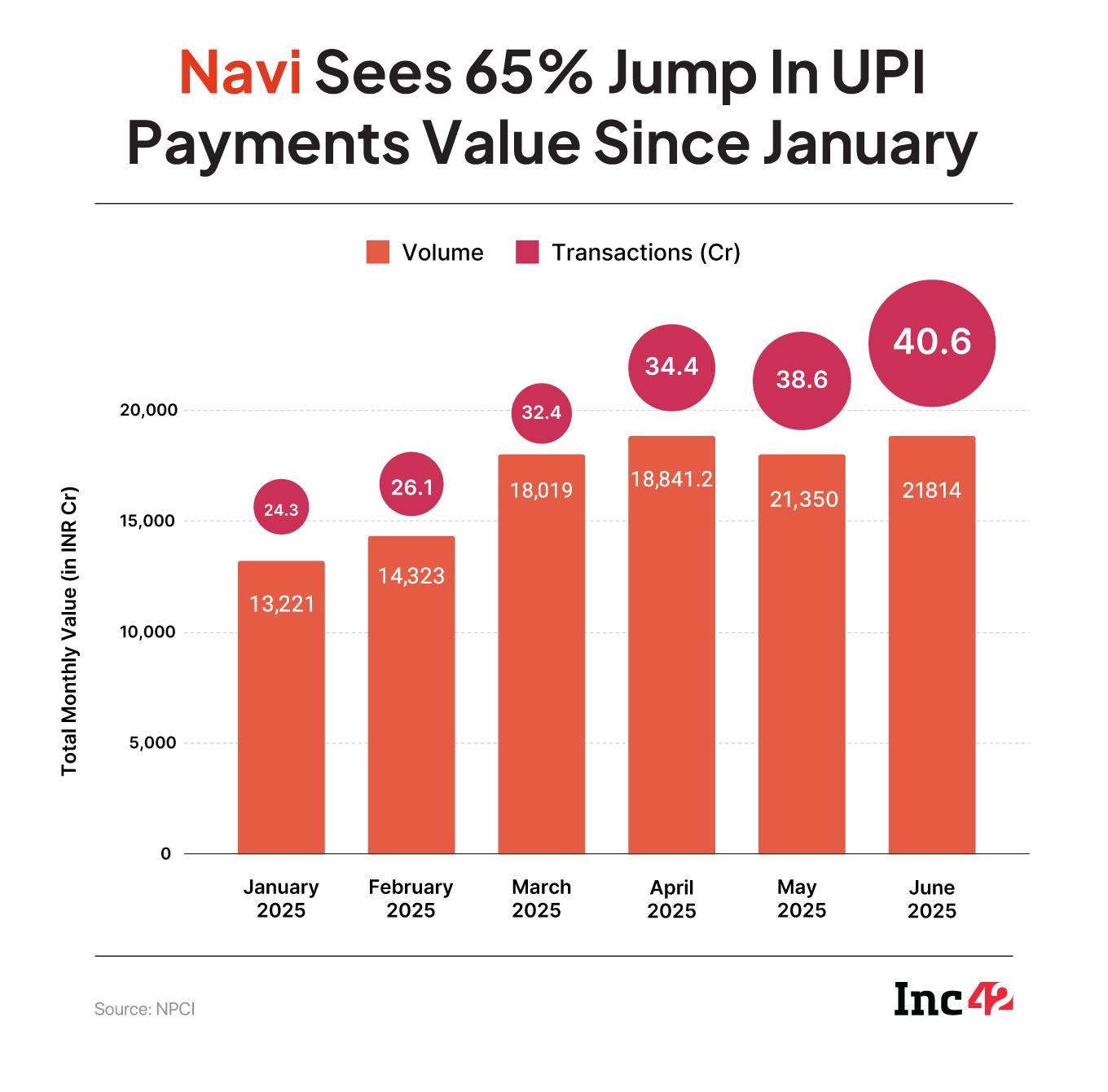

Navi’s Surge Since LaunchSachin Bansal-led Navi has emerged as a significant UPI player in India since October 2024, and a lot of its growth has been built on user acquisition through cash burn and digital marketing.

From a cumulative transaction value of INR 8,806 Cr in November 2024, Navi’s transaction base has grown to over INR 21,800 Cr as of June 2025. In the first six months of 2025, Navi had an average monthly transaction value of almost INR 18,000 Cr with an average ticket size of INR 548.

The platform’s cashback and “Navi Coins” incentive system has helped attract users, but it also weighs on profitability.

For 9M FY25 (ending December 2024), Navi’s consolidated net profit dropped by roughly 70% YoY to INR 191.6 Cr, even as operating revenue rose 33% YoY to INR 1,526.2 Cr.

Flipkart’s super.money Races UpAnother relatively new player in the UPI apps space is Flipkart-backed super.money, which was launched in July 2024 and has raced to become a major UPI player, especially when it comes to the number of transactions.

Its aggressive cashback campaigns have helped it surpass rivals like CRED, Amazon Pay, and WhatsApp Pay. However, like Navi, super.money’s average ticket is extremely low — around INR 350 — meaning it currently doesn’t benefit from the proposed MDR framework.

Plus, the company’s financials are undisclosed as of now so it’s not clear how much super.money has spent to get to this position in the UPI apps standings.

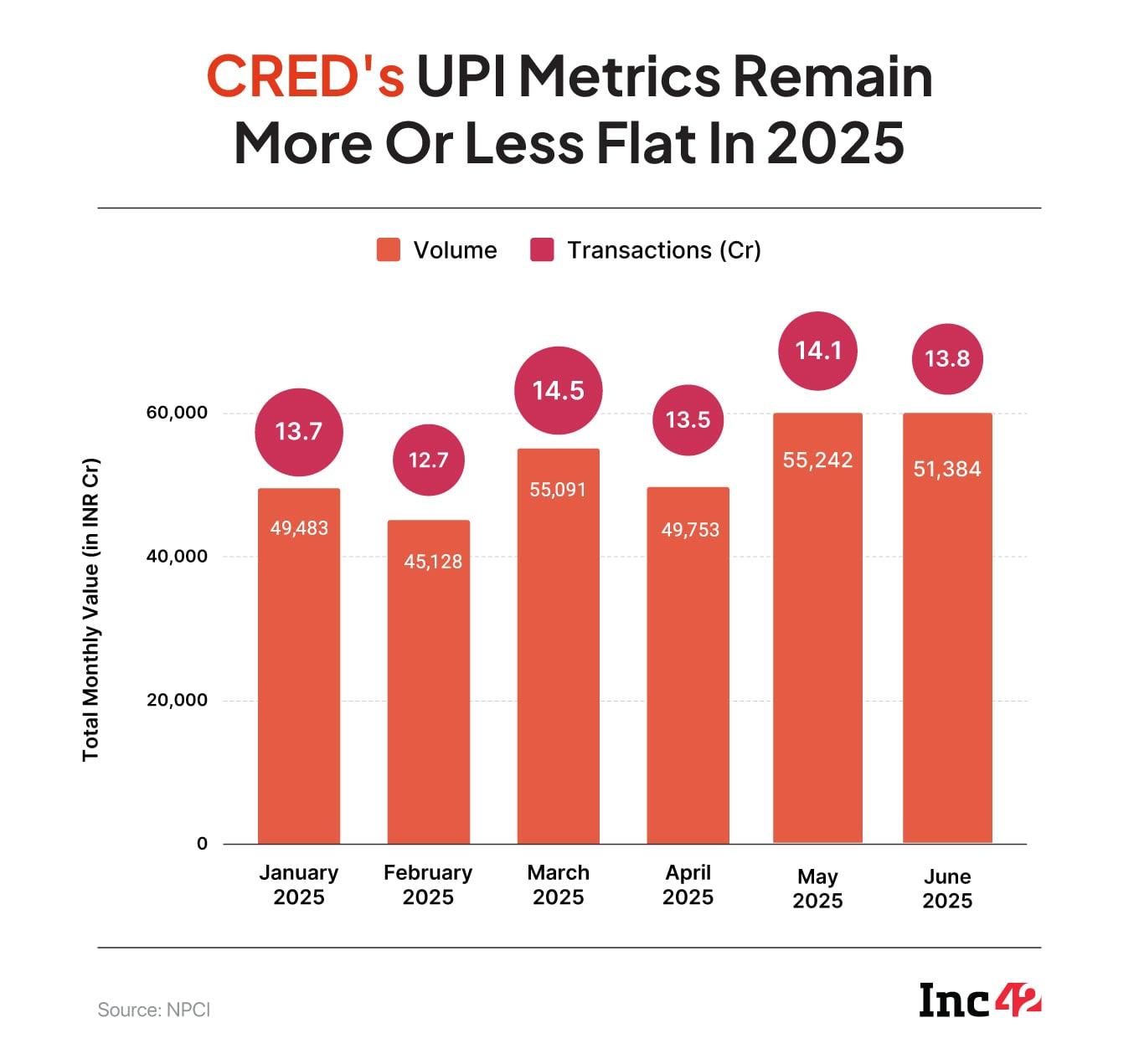

What’s CRED’s NicheKunal Shah-led CRED is a darling of the fintech world, and it has one of the highest average ticket sizes in the UPI apps.

In fact, with an average of INR 3,700 per transaction (across January to June 2025), CRED is one of the few platforms positioned to directly benefit from the new MDR model, if the rules are adopted as proposed.

CRED’s focus on credit card bill payments, premium retail outlets and high-value users has kept its transaction volumes moderate but value-heavy. However, outside the top three apps, CRED has the biggest base for total transaction value at over INR 51,000 Cr per month on average in 2025.

While its absolute UPI ranking has fluctuated between rank 5 and 7, the startup’s strategy centres around the super app model, where it funnels users to other high value purchases through UPI.

In FY24, CRED’s operating revenue rose 71% YoY to INR 2,397 Cr, while loss narrowed 41% to INR 609 Cr.

Will Groww’s UPI Strategy Deliver MDR Boost?Groww is the next biggest player in terms of transaction value among the underdogs, but this is not the key advantage for the IPO-bound company.

The Bengaluru-based unicorn boasts the highest average ticket size among all listed players — ranging from INR 6,000 to over INR 7,000 — mostly due to its investment-led use case. What is not clear is whether using Groww UPI for investments or IPO bids would qualify as a ‘large merchant’ payment because it is a related party in Groww’s case.

Plus, Groww’s transaction volume remains relatively low, with around 1.2 Cr transactions monthly, and the app has slipped in UPI rankings from 19 to 23 over the past six months. So even though it has an advantage in terms of ticket size, Groww needs to do a lot more to get users to adopt its UPI app.

What’s Next for Smaller UPI Players?A surprising entry in the list is FamPay’s FamApp, which climbed to eighth in the UPI rankings in the past three months, clocking more than 11 Cr transactions in June 2025. However, this app has the lowest ATS among all at INR 110–125, putting it well outside the bracket that might benefit from MDR.

One reason for this could be the app’s focus on teen consumers, which limits the spending capacity. However, FamPay has significantly reduced its losses — from INR 100 Cr in FY23 to INR 13.5 Cr in FY24 — despite modest revenue of INR 25.2 Cr.

With MDR likely to apply only on transactions above INR 2,000 and limited to large merchants, most UPI startups with low ATS may initially be left out of the monetisation windfall. However, this particular aspect is not yet clear since the rules and contours of the MDR policy are yet to be officially announced.

The key matrix for MDR monetisation will be a combination of high average ticket size, growing peer-to-merchant transaction share, and merchant acquisition at scale, especially large merchants and retailers.

Those apps that manage to achieve this trifecta will be best placed to eventually benefit.

Is MDR Biased Towards Bigger UPI Apps?Smaller players, with underwhelming average ticket size numbers, are taking a common approach to make in-roads within the UPI ecosystem. This includes forging partnerships for large ticket transactions, incentivising larger transactions through cashbacks and discounts, and leveraging platform features for cross-selling.

super.money founder and CEO Prakash Sikaria told Inc42 that there seems to be a consensus within the industry that the introduction of MDR could fuel innovation, provide incentives to banks and fintechs to invest in better infrastructure, improve user experience and fraud prevention systems. However, he cautioned that the MDR levy might end up benefitting just the bigger players.

He believes apps will be compelled to take a diversified approach. “Tiered rewards can motivate users to consolidate payments or make larger purchases via UPI, increasing the average ticket size organically. Plus expanding UPI acceptance in sectors like healthcare, education, and travel can help shift transaction volumes toward higher-value categories,” Sakaria told Inc42.

Like many other industry insiders, the Payments Council of India (PCI) is also looking at MDR closely to avoid a systemic risk in the payments ecosystem. PCI chairman Vishwas Patel believes that the primary beneficiaries of MDR would be major players, who command a large volume of P2M transactions.

“The ones to gain the most would be PhonePe and Paytm, who have a large merchant transaction base. For smaller players like POP, Navi, FamApp and others, I don’t foresee much gains given their focus on P2P (person to person) transactions more than P2M. To gain some of the benefits of the MDR, these companies need to build up their merchant transactions as well,” Patel added.

Sakaria of super.money believes the MDR structure will be just as critical as the implementation. “If MDR is introduced without a level playing field or adequate checks and balances, there’s a risk it could concentrate power further into the hands of a few large players, making UPI more monopolistic. That would be counterproductive to the very innovation we are hoping to encourage,” he cautioned.

Even as UPI apps and fintech startups continue to remain bullish about MDR, there is a real danger that this change could be more detrimental to apps than the status quo.

The post Beyond The Top Apps: Will MDR On UPI Lift CRED, Navi, Groww And Others? appeared first on Inc42 Media.

You may also like

Mikel Arteta warned 'unfair' treatment could see Arsenal star leave after £52m transfer

Thames Water reveals huge debts day after confirming hosepipe ban for 1.1m Brits

Kriti Sanon Cheers for India at Lord's with Kabir Bahia

College Tips: College is not a means to get a job, it is a platform to enhance your identity and passion; keep these things in mind..

Kejriwal slams Gujarat govt over lathi charge on protesting livestock farmers in Sabarkantha